You can import payroll data into MGL that has been entered into the Lewis Paypack payroll system and then exported to a CSV file.

This topic explains how to create a standing journal template in MGL for your Lewis Paypack data. This is the first step in the process of importing your payroll data from Lewis Paypack.

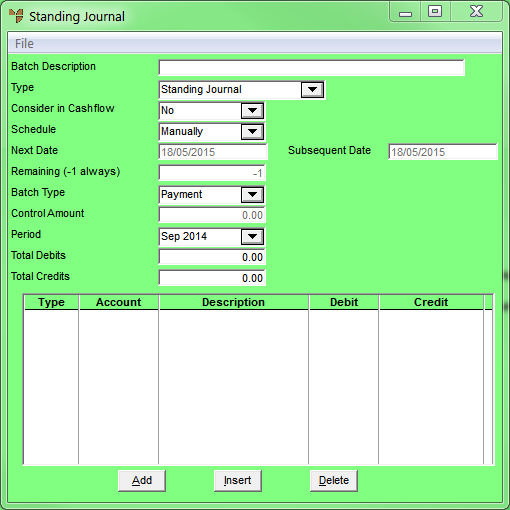

Micronet displays the Standing Journal screen.

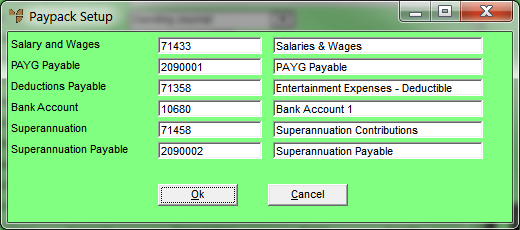

Micronet displays the Paypack Setup screen.

|

|

Field |

Value |

|

|

Salary and Wages |

Select the GL account for salary and wages, or press spacebar then Enter to select an account. This account will be debited with the total of the salary/wages, holiday pay, sick pay, annual leave, allowances and lump sum payments. |

|

|

PAYG Payable |

Select the GL account for Pay As You Go tax, or press spacebar then Enter to select an account. This account will be credited with the tax amount. |

|

|

Deductions Payable |

Select the GL account for deductions payable, or press spacebar then Enter to select an account. This account will be credited with the deductions amount. |

|

|

Bank Account |

Select the GL account from which the payroll is paid, or press spacebar then Enter to select an account. This account will be credited with the total of the Salary and Wages minus the PAYG Payable and Deductions Payable. |

|

|

Superannuation |

Select the GL account for superannuation contributions, or press spacebar then Enter to select an account. This account will be debited with the super contributions amount. |

|

|

Superannuation Payable |

Select the GL account for superannuation payable, or press spacebar then Enter to select an account. This account will be credited with the super contributions amount. |

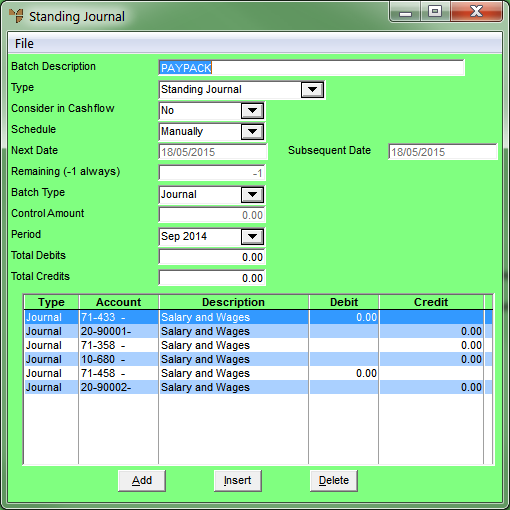

Micronet creates a standing journal batch with the description “PAYPACK” as shown.

To import payroll data and process the payroll, refer to "Importing Payroll Data from Lewis Paypack".